Brand Awareness Strategies & Tactics: A Customer Q&A

Read on to learn how these marketing experts grew their brands in 2023 and which strategies and tactics they are prioritizing for 2024 and beyond.

Read More

The novel coronavirus pandemic sweeping the globe has already drastically changed the way society operates. Between shelter in place orders, massive closures, disruptions in supply chains, and a sense of impending dread, 2020 is likely to go down as a year future students learn about in history books. But is it changing the way healthcare operates?

Image: Today's Wound Clinic

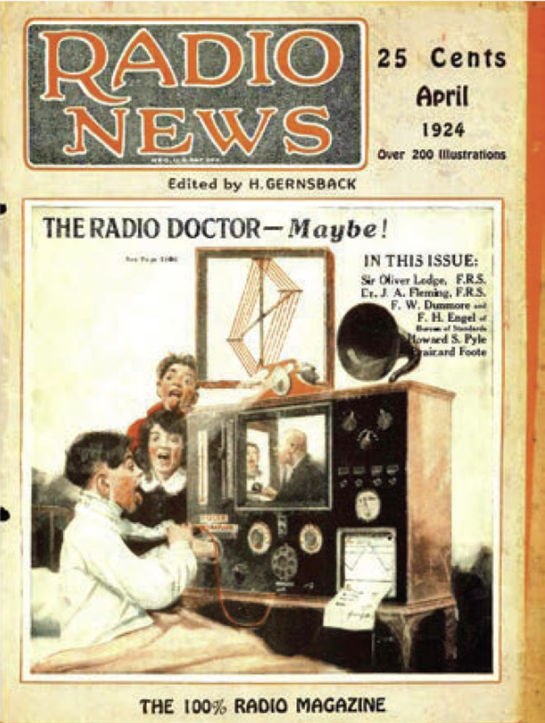

Telehealth and telemedicine are not new. The earliest recorded incident comes from an anonymous letter to The Lancet in 1879 describing a doctor diagnosing a child over the phone in the middle of the night. By the 1920s, science (and science fiction) magazines were full of speculation about the various long-distance communications devices that doctors could use to remotely speak with and diagnose patients. By the middle of the 20th century, medical diagnoses over the phone had dropped out of the popular imagination because they were so routine as to be boring. And from the earliest days of the internet, physicians, programmers, and futurists have been envisioning ways to bring medicine into the digital world.

Ro, the focus of today’s Unrolling, didn’t start as a telehealth force. Founded in 2017, the company began with a simple goal: to make it easier for men suffering from erectile dysfunction (ED) to receive treatment. Their thesis, born out of personal experience dealing with the condition, was that men were uncomfortable making doctors’ appointments for ED, speaking with clinicians about their ED in person, and getting prescriptions filled.

Ro has grown to cover men’s and women’s sexual health, smoking cessation, allergies, weight management, and many other conditions. But the important point to remember is that they didn’t start that way.

A look into how Ro has found success starts with two fundamental points: One, telehealth and telemedicine are not the same thing, and two, as previously mentioned, neither are new ideas. This is critical to understanding how Ro has managed to grow so quickly in such a short amount of time.

While telehealth and telemedicine are often used interchangeably, they really represent two different, though related, ideas. Telemedicine is often what people actually think of when they think about the future of medicine — doctors speaking with patients over video, connected treatment devices, and similar technologies. Specifically, telemedicine deals with the clinical side of health and wellness.

Telehealth, on the other hand, encompasses a much broader range of technologies, services, and devices. Telehealth refers not only to clinical interventions, but to all of the wellness and health services used by society, as well as the infrastructure that supports them. This includes things like fitness and diet trackers, electronic medical health records, mail-away pharmacies, and personal health apps. To put it all into perspective, telemedicine is just one component of telehealth.

Both concepts have been around for far longer than most people realize. In prehistoric and classical times, the sick would often send representatives to run to physicians with a list of symptoms and return with a cure or advice. Ancient cultures used signals to send messages about plagues and outbreaks to neighboring villages. As technology advanced, the mechanisms used to transmit health information became more sophisticated — post to telegraph to telephone to the internet — but the underlying concept hasn’t been “new” for thousands of years.

Modern telehealth and telemedicine, as we know it, began in the early 2000s, with a company called Teladoc. The company used lessons learned from the co-founder’s experience with NASA to create a network of physicians that could see patients virtually. Their early success started off a gold rush of competitors and niche services, each trying to grab a piece of the $8.734 trillion global healthcare industry.

By the time Ro came about (initially started as Roman), there were hundreds of competing telemedicine and telehealth companies operating throughout the world. Some focused specifically on connected devices, others on storing and transmitting patient data, and many were simply unspecialized services like Teladoc that connected physicians to patients. There wasn’t (and still isn’t) a clear and recognizable market leader, but the landscape was cluttered enough that it was becoming difficult to get attention without having a clear hook.

Zachariah Reitano, one of the three co-founders behind the startup, had a long personal lesson on the importance of men’s health. At the age of 17, he had been hospitalized and required emergency surgery for a critical heart condition. Throughout the ordeal, and well into recovery, Reitano struggled with ED — first as a symptom of the condition and then as a side-effect of the medication keeping it under control. It’s the kind of founding story that not only provides a great media narrative, but also sets a clear direction. In a crowded field, Ro would focus on men’s health, starting with ED.

Founds of Ro / Image: CNBC

The gamble paid off. By the end of 2018, Ro had raised just shy of $100 million in seed and series A funds. The company grew from five employees to 70 over their first year, expanded services to offer smoking cessation products, and opened up a line of women’s care products, as well as offering treatment for conditions far beyond their starting point of ED and building out their own “cloud pharmacy” to vertically integrate the entire patient experience.

Ro is hardly the only telemedicine startup that’s gaining attention. In fact, we wrote about one of their competitors, Hims, in an Unrolling double feature earlier. What’s telling about looking at both of them together, compared to a company like Teladoc, is how similar their growth has been. Both have taken nearly identical routes to break out, and both have seen tremendous success because of it. So what’s the secret sauce to standing out in a crowded market?

The stereotype of men and healthcare is that the former tries to stay as far away from the latter as possible. And while many stereotypes are hurtful and incorrect, this one happens to be true: Men seek out healthcare far less often than women, and often wait until conditions are far more serious before seeking it out. Interestingly, this holds true across ages, cultures, and continents. Men, as a gender, are far more reluctant to speak to a physician.

There are a lot of theories about why this is. These range from social notions of machismo and strength, to economic explanations pointing out that men typically provide the majority of support for families and have less time off to visit physicians, to simple embarrassment about talking frankly about very personal subjects.

Ro, from their very early days as Roman, capitalized on all of these explanations. The name itself, Roman, was picked to overcome some of the emasculation men might feel when talking about ED. The colors, logo, font — the entire branding package — was conceptualized to overcompensate for the blow to the ego that came with admitting to having issues in the bedroom. And the prescriptions come in discreet packaging, to boot.

Image: Medium

The rest of the process builds on that to deal with the other issues. The app makes it easy to get an appointment, freeing men up to do so when they have time without disrupting work. The appointment itself is structured to be impersonal and mechanistic, largely removing the need to speak to another human being directly. The total package addresses most of the concerns for the primary audience Ro wanted to cultivate.

It would have been incredibly easy to cobble together yet another general-purpose telemedicine app to launch on the market. In the late 20-teens, venture capitalists were willing to toss huge sums of money at anything with the words “digital” and “health” anywhere in the pitch deck, and the underlying technology isn’t anything earth-shatteringly complex or novel.

Of course, with a general-purpose telemedicine approach, it’s likely that Ro would have been completely lost in the sea of other generic, general-purpose telemedicine applications. By focusing on one very specific and well-defined niche, Ro was able to create space for themselves to gain traction and become a well-defined and well-known brand. Instead of competing with everyone, they only needed to compete with other men’s health telemedicine services specializing in ED — which at the time of their founding was a field of one, largely owing to the sensitive nature of the subject.

Playing in a space where customers don’t want to be associated with the brands they use can be a tough proposition. Or, as Reitano says, “Roman doesn’t lend itself to the typical Instagram unboxing experience.” Unlike many other modern direct-to-consumer (D2C) brands, Ro never had a chance of really going viral.

Instead, the brand focused on areas where it knew it could win. Word of mouth on social media was out. Word of mouth in locker rooms and personal conversations between guy friends was in. And since most of Ro’s competitors at the time of their launch were shady, off-brand online pharmacies, many of which sold counterfeit drugs, they were able to leverage press and other publication mentions to win the SEO game. Rather than following the traditional D2C playbook, the brand took a very traditional approach to getting their name out and made it work.

One of the biggest advantages Ro had going in was a very clear product roadmap and plan for reaching scale. From the beginning, they were focused not just on building out an app to get Viagra prescriptions, but an entire ecosystem of services that would allow them to control the experience from start to finish. This was a very D2C idea, but it hadn’t really been applied to telemedicine before that.

Building out their own pharmacy, patient record storage system, and physician network allowed Ro to quickly transition out of only selling ED medication. Once the initial template was created, moving into hair loss or bone health or weight management medication required little other than taking that template and changing a few elements. This allowed the company to quickly spin up their Zero smoking cessation brand, and then their Rory brand for women’s health at little additional cost.

This kind of scaling mindset was key to the funding success that Ro had and to their explosive growth. In a sense, what Ro was building from the beginning wasn’t a D2C brand or storefront, but a platform for launching multiple brands and storefronts easily. This was largely the same model that allowed Hims to scale quickly as well and is an integral part of both brands’ success stories. This is also why the distinction between telemedicine and telehealth becomes so important. Telemedicine is, by its nature, a limiting approach — there just aren’t that many avenues for growth. Instead, focusing on telehealth — on building the infrastructure that would allow them to permute and experiment with their options — gave Ro the space they needed to grow.

The current COVID-19 pandemic is making the need for telehealth even more clear than it’s already been. By the time the dust settles, it may have been months since many people have seen their physicians, and many treatments will have been put on hold. Having options, like Ro, will be more and more critical over time. Especially as many doctors believe this won’t be the last quarantine the world sees.

But the lessons of Ro’s success are applicable for companies far beyond the world of telehealth, too. The most important lessons here are:

Find a niche. It might be tempting to start by trying to capture the entire total addressable market (TAM). And for some industries, especially ones that are relatively small or specialized, that may not be a terrible idea. But for a lot of cases, the TAM is simply way too large to be able to approach efficiently. The more niche an application or product, the easier it is to build out a highly specific and targeted plan to attack it, and the better the results.

It’s important to plan not just the first steps, but the second, third, and fourth. Growth rarely just happens organically. More often, it’s the result of years of preparation and ground-work. Having a detailed plan of where that growth should take place will help companies make the kind of long-term strategic decisions that will allow them to use resources more effectively both in the short and long terms.

Find opportunities to scale anywhere and everywhere. Not every company needs to be vertically integrated, or composed of rearrangeable modules that can be remixed endlessly. But the best D2C companies typically are. Being able to stand out, especially in crowded industries or when competing against much larger established brands, often means finding economies of scale wherever possible. That can mean flexible process templates, or it can mean building and controlling manufacturing and distribution expertise, or a proven marketing strategy that can be adapted for multiple campaigns. Having scalability built in not only simplifies growth, but opens up possibilities for new growth opportunities to explore.

Last updated on September 16th, 2022.