How to Build Brand Recall in a Clickless World

Brand awareness is dwindling in organic search. Here's your strategy for building brand equity and recall by leveraging brand awareness. Learn more here.

Read More

In this special Unrolling double feature, we’ll look at LOLA and Hims, two hot health and wellness brands focusing on reproductive health. That might make some of our readers uncomfortable — lean into that feeling because it’s is critical to understanding how these two companies have been able to gain so much traction so quickly. Readers may also find that they react differently based on their sex or the gender they identify as — this is also important because it helps explain how two companies evolve in different ways despite largely the same mission.

LOLA (not to be confused with travel startup lola.com) was launched in 2015 by Jordana Kier and Alexandra Friedman. The two women grew up practically next door, attended the same college for undergrad, but had never actually met until a mutual friend introduced them at a point where both were looking to branch out into entrepreneurship.

The two women bonded over their many shared connections but found that the biggest connection they had was something far more intrinsic than where they grew up or studied. Instead, it was the episodic nature of simply being a woman — the trials, mishaps, and near misses of dealing with a monthly ritual. A ritual that somehow manages to be big business and a conversation-ending taboo. Periods are unavoidable, and it seemed they were also undiscussable, at least in public.

Hims, on the other hand, is less a story of serendipitous kismet and more of startups as industrial science. Born out of a startup studio, Atomic, it’s hard to say who owns the idea or where exactly it came from. What isn’t hard to say is that chief executive officer Andrew Dudum and his team have a knack for picking thorny topics and making them thoroughly millennial-friendly.

Hims was born out of that spirit. The original plan: make erectile dysfunction (ED) “fun,” as a glib New York Times article puts it. The idea was brilliantly simple. Erectile dysfunction treatment was a known quantity — a smash hit that completely changed the way pharmaceutical companies measured success, with over 150,000 prescriptions for Viagra filled in the first two weeks of sales. But despite that success, all of the marketing for ED was aimed squarely at aging boomers, leaving the entire under-40 market completely behind. Until Hims (and competitor Roman) came in to shake things up.

Despite their wildly different origin stories (and their diametrically opposed approaches to capitalization), LOLA and Hims have a lot of similarities. Both are technology-driven approaches to personal wellness. Both focus on giant industries dominated by a few legacy corporations, many of which have missed the mark in trying to connect with millennial customers. And both play in spaces that have traditionally been very private and taboo topics in polite company.

LOLA was built to make dealing with periods easier; Hims to bring ED in younger consumers out of the shadows. Both are topics that quickly bring conversations to a halt, assuming they get introduced at all. But the way that these companies deal with these similar topics is very different. And this is the big story to address here, and why this episode of Unrolling comes as a double feature.

In the 1970s, it was the official policy of the National Institutes of Health (NIH) to recommend against including women of child-bearing potential in many clinical trials. In fact, it wasn’t until 1993 that federal regulations began requiring women’s participation, and the problem is still pervasive enough that the NIH’s Office for Research on Women’s Health is still working on guidelines to increase female participation in research. All this is to say that the taboo against discussing women’s reproductive health is strong (warning: link contains graphic medical descriptions), even among medical professionals.

What conversations do happen about the topics of periods happen in small groups of close friends. Many of these groups don’t include clinicians. Many pass around the same limited information, much of which is based on common wisdom and rumor rather than medical research. Many had no idea how the products they used every month were made, or what they were made of.

That’s the environment LOLA found itself in shortly after launch — conversations in the dark in small groups. Even on a medium as female-biased as Instagram, the largest legacy tampon brand only has 23k followers — lower than many top individual influencers. Their first marketing priority became taking these conversations and bringing them out of the shadows and connecting the individual threads into a tapestry of the female experience. To bind these micro-communities into a single large network able to share their thoughts and experiences, and push for change in the conversations around and about women’s health needs.

Things weren’t much better for men. Pfizer may have broken down the taboo for talking about ED in public, but the conversation was entirely focused on older men. “It’s okay to have ED when you’re older,” the advertisements seemed to say, “it’s not your fault, and we’ll help you enjoy your golden years like the virile lion you are!” But for younger men, particularly men in their 20s and 30s, ED was still largely seen as a personal failure or a dark secret to be ashamed of.

That men don’t like sharing concerns about their health isn't surprising. Study after study finds that men simply don’t feel comfortable sharing health concerns even with doctors. Men tend to wait much longer to speak to physicians about health problems, often waiting until an illness has progressed to a serious stage. And unlike women, men often don’t even feel comfortable discussing these issues with close friends and family members.

The challenge facing Hims, then, wasn’t to bring small groups into a larger community, but simply to get people talking in the first place.

Hims debuted to sales of over $1 million in their first week of operation, and an immediate funding round of $7 million, and became a unicorn in early 2019. LOLA had raised over $35 million as of 2018. By any objective measure, both companies are huge successes. And while the companies have taken slightly different approaches, there are a number of critical overlaps.

Even though both companies have a specific mission to grow the conversation around women’s and men’s reproductive health, both also offer something that was previously unavailable in the space: privacy and anonymity. Hims replaces traditional physician consultations with telemedicine appointments over chat messages and video calls, eliminating the need for face-to-face interactions. Both ship products directly to consumers in minimally-branded, discreet packages. Both offer carrying pouches for personal items that allow users to keep them on hand without advertising their needs.

Image: forhims.com

This focus on privacy and discretion might seem to be contradictory to the primary mission of open communication, and in some ways it is, but it’s also a very practical solution to the problem. Open communication is great, but two companies aren’t going to change centuries of cultural baggage overnight. And there’s a big difference between talking about ED or periods on Instagram and chatting about it with a doctor or convenience store cashier.

Neither of these industries is new or under-capitalized or under-marketed. Pfizer spent over a billion dollars on advertising in 2014, much of it on Viagra. In June 2019, Proctor & Gamble, owner of the Tampax brand, announced that they were spending over $6.75 billion on advertising — actually a decrease from the previous three years. But despite spending more on advertising than the GDPs of several small nations, legacy companies often ignored or barely acknowledged younger markets.

Look at the classic ED commercial: A silver-haired man is driving his vintage convertible to the golf course, or the beach, or an elegant restaurant, his attractive and age-appropriate wife by his side, ready to enjoy everything retired life has to offer. “You’re getting older,” the commercials say, “but you can still enjoy all life has to offer.”

Image: Chicago Tribune

On the other side is the typical feminine product commercial: women of all ages run around, playing sports, swimming, wearing white pants, and otherwise doing things many women are reluctant to do while on their period. The activities are universal to the point of being generic — sometimes they show a younger woman, sometimes an older one, but the situations they find themselves in have all of the specificity and personal connection of a trip to the Department of Motor Vehicles.

Image: playtex.com

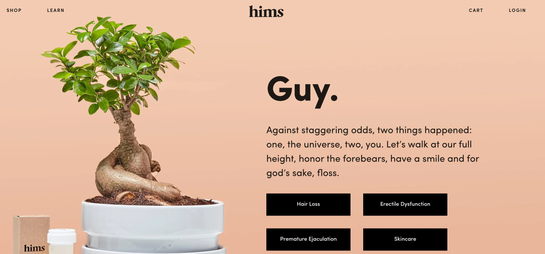

LOLA and Hims branding, on the other hand, have thoroughly embraced the millennial market. It shows through in the colors used on their websites — the rich but muted earth tones that are the hallmark of the under-35 crowd. The typography is bold and minimal, and the sites are awash in the latest design. And the models that appear (or un-models, as they are in many cases) are young, diverse, and doing the things millennials are supposed to be doing: skateboarding, hanging out at hip urban bars, practicing yoga. Compare that to the sites for Viagra and Tampax, which look to have been developed sometime around 2001 and not updated since.

Image: forhims.com

Image: mylola.com

Hims has especially radically transformed the way content is treated by a health and wellness brand. There’s no obvious legalese anywhere. No disclaimers. No bold lists of side effects or warnings to see your doctor. There’s hardly any formal language at all. The punctuation is all over the place, and the tone is light, playful, and conversational.

Taking a sharp detour from traditional approaches to medical content, Hims seeks to recreate a conversation between guys. All of the copy is meant to be read in the same tone as having a chat with your best friend or a gym buddy. The focus is not on the medical condition a potential user may have. Instead, it’s about practical “guy” advice, the same guy advice that can be found on the pages of GQ and Men’s Health. And the advice isn’t “You may have a serious medical condition and need to consult with a physician immediately.” Instead, it’s “Bro, why aren’t you living your best life?”

Image: forhims.com

This shift in tone may seem subtle to those not steeped in dude culture, but it’s a critical first salvo in the war to get men talking to each other about common problems. While women have traditionally been more comfortable talking about health issues with close girlfriends, men have not had those same relationships. Changing the tone of the conversation is critical to getting the conversation started; addressing men in the tone they already use, but for topics they aren’t currently discussing, is the first step in normalizing this conversation.

Female consumers care more about what’s in their products than consumers as a whole. Millennial women even more so. Studies have found that legacy brands haven’t done a good job of making their labels clear, despite women being willing to pay more for simple ingredients.

Image: mylola.com

LOLA capitalizes on this trend by making clear, simple ingredient lists as a core part of their marketing message. From start to finish, the marketing is full of “100% organic cotton” labels, and bold disclaimers about the lack of artificial dyes, additives, and components.

At a time when selling organic produce is an easy way for grocery stores to increase revenues, and the organic market is growing at 6% per year, it’s amazing that it took a startup to create widely-marketed organic alternatives to traditional feminine hygiene products.

This focus on simplicity and understanding of what goes into one's body is a critical point of differentiation for LOLA. They weren’t the first period delivery box on the market, but they were the first to make a big deal about what they were selling, not just how they were selling it. This point of differentiation is a big departure from Hims, which focuses much less on what’s in the product and much more on the tone. Women, according to LOLA, don’t need their companies to spur intimate conversations. What they need is to provide clear answers about what is inside their products and why that’s important.

Two brands, one mission. One mission, two audiences. Very similar, but also very different approaches. LOLA focused on adding transparency to an opaque industry and bringing many small conversations into one big one. Hims added anonymity to a very personal problem and tried to turn no conversations into intimate conversations. LOLA proudly features customers and testimonials on their website and social feeds. Hims mostly sticks to models and speaks to customers individually, one to one. Both are fighting gargantuan established industries, and an even more gargantuan established culture and both appear to be winning. LOLA and Hims both contain critical lessons on how to succeed as a D2C brand together and individually:

Your audience is the most important driver of your messaging. Even though LOLA and Hims play in very similar spaces and are facing very similar challenges, their tone and voice and approach is very different. By tailoring every aspect of their brands to their specific audience, both were able to overcome the very real challenges of going up against industry behemoths. It’s impossible to stress enough how important it is to know your audience.

LOLA was able to gain tremendous traction simply by making an effort on Instagram and Pinterest — two channels that are famous for being dominated by women, and ones that traditional companies largely ignored.

Hims spoke to young guys the way young guys were used to being spoken to. They eschewed the formality and technicality of traditional pharmaceutical companies and found success by using simple English and a conversational tone.

Look beyond convenience. Convenience has often been touted as the pinnacle of D2C values. But convenience doesn’t build brand loyalty or enthusiasm — lots of companies are convenient. Instead, look to address the needs and desires that go deeper than convenience. LOLA and Hims both identified the embarrassment of buying reproductive care products as a major obstacle to consumers. Both address it head-on to great effect. They’ve also used it to grow beyond their initial products.

Hims expanded its services from ED treatment to treatment for hair loss and other embarrassing male conditions, and then to hers, a sister brand that sells many of the same products for women.

LOLA also expanded, going from delivering tampons and pads to also selling vitamins, condoms, and personal lubricant — things many people are also embarrassed to buy in person.

Design matters. Focusing on written content alone as a way to distinguish a brand misses just how much information is conveyed through visual design. Visual communication tells consumers who a brand is for, what the brand’s values are, what they can expect from a brand — all of the subconscious cues that make consumers sit up and think “yeah, this brand is for me.”

The importance of visual design on forging true consumer-brand relationships stretches from the logo to the images posted on social media. Building a cohesive design language strengthens that relationship every time consumers encounter it. It also helps define audiences — consumers are drawn to brands that look “like them.” Looking at the website for Hims and comparing it to LOLA, or even to hers, makes this point clear: There are a lot of similarities, but also subtle differences that immediately shout “this is for you!”

Now that you know how LOLA and Hims skyrocketed to success, read about Supreme next.

Last updated on December 9th, 2022.